Monthly View - Bullish

Weekly View - Neutral

Daily View - Bearish

Weekly Chart of Nifty -

1st Week of

May Candle or Bar given the negative confirmation by forming 1st lower low

formation and this negative sign was exactly from the 78.6% level which have

more significance. Hence, we can evaluate that 8000 will be the crucial

resistance for further....

(Last week comment - Outside bar for last week

of Apr indicate indecisiveness, Outside bar is actually Continuous trend

pattern, Hence Next Week Bar is needed to watch to confirm the trend ahead.. Since

is indecisive bar, The high probability of last uptrend will continue further

until there additional negative signal....As per Fibonacci study, Currently

Price tested and hovering near 78.6% level (strong resistance) of previous

down swings. If Price is sustained and

breach of this 8000 level , then 8350 target will get achieved easily..).

On downside,

there was strong resistance at 7500 & 7400... Hence, 7400 - 8000 is the

range where market might remain sideways and consolidating for few days or

weeks... Hence, Breach of this range will confirm the further trending move.

AS per Neo

wave, we will keep "X2" wave as question as it will get confirm only

if this complete upmove(6825 - 7992) retraced faster in time which is rare

possibility as of now.

Small NRD

trendline has been removed as price breached its previous minor swing high

7979.30 and made top of 7992.

Long NRD is

possible but it will get confirm only after breach of 7400 level, hence it is

still in question.

(Last week

comment - As of now there is no validity or confirmation NRD (Negative Reverse

Divergence). As per Elliott wave theory, Complete downmove is complex

correction with WXY (2 standard correction adjoined with X1). We will continued to mark current countermove

as X2 until the breach of 8340 (as that was the level confirms the downmove

ends).

Also, RSI

is making the higher Swings whereas price couldn't breached its corresponding

price swings which indicate weakness and potential to established the Negative

reverse divergence. Price is to confirm the NRD)

As per Candlesticks chart, The Last week

candle formed lower low which confirms bears wins the battle as of now and hence

Bulls will get in power only after breach of 8000. The last week candle forms

with lower volume as per the previous volume bar which indicates initial days

of the next week will be positive. Yes, it means the possibility of minor

pullback on Monday or Tuesday. this is

will give the opportunity to buyer to exit their bulls positions as nifty will

going to remain sideways to negative for few days or week.

(Last week

Comment - As per Candlesticks chart, The

current week candle looks like doji with bigger body compared to earlier week

candle. This indicate the tough fight between Bulls and bears at this

resistance level. Coming week candle

will clear the who will wins from this battle.... )

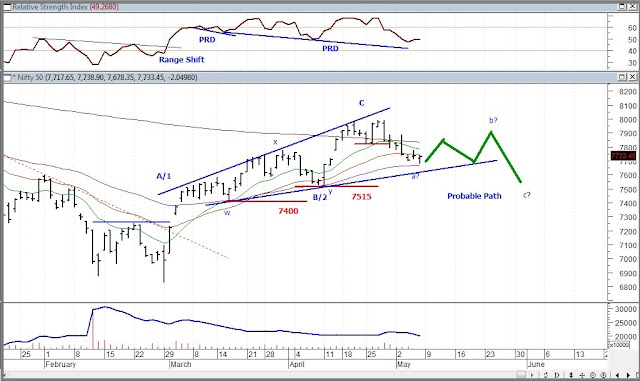

Daily Chart of Nifty -

* Price

closed below 200SMA, Trendline support broken, Lower low formation confirms

that Daily trend becomes bearish.

* Last daily candle suggest that Hammer at

bottom. if High of this candle broken on Monday then minor pullback towards 7850

is possible

* As per

Elliot wave, Price is in the wave "a" and if pullback confirm then

"b" wave can start which will be tedious to trade.

* Hence ,

next week will be very difficult for Positional trader.

*

"c" can be tradable for downside after end of "b" wave,

hence sell on rise is the market in simple term.

* Probable

path shown in the chart.

(Last week

Comment -

As per

Daily Chart, Price is hovering at 200 SMA and tested 78.6% of Previous

downswing.

Price is

continuous to be bullish and in higher top formation.

There was

minor swing breach downside but price is still above the support trend line.

As per

Elliot wave, Price is in "2nd or b" inner wave of C wave... End of

these inner wave, Price will again move further upward as "3rd or c"

inner wave of C.

Breach of

7515 & 7400, will consider end of this uptrend, till that time- Price will

be in Bullish grips only...)

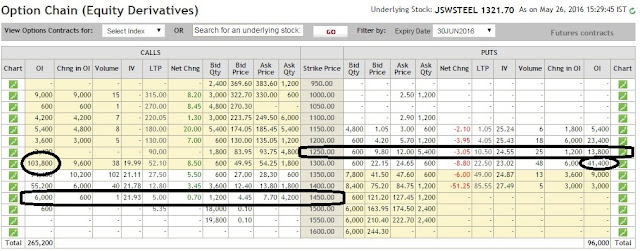

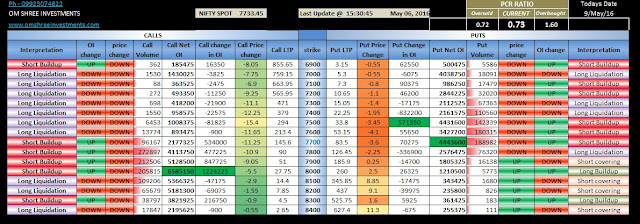

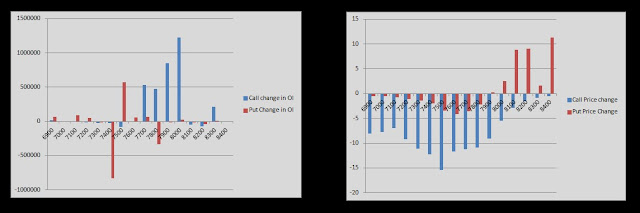

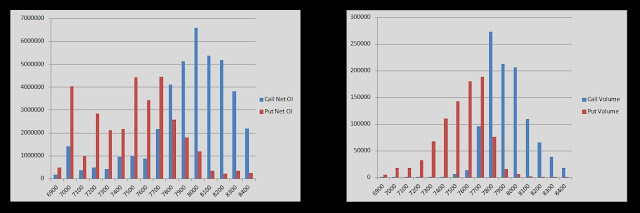

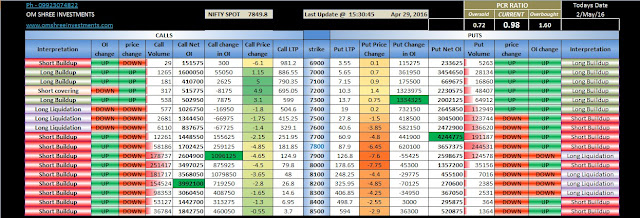

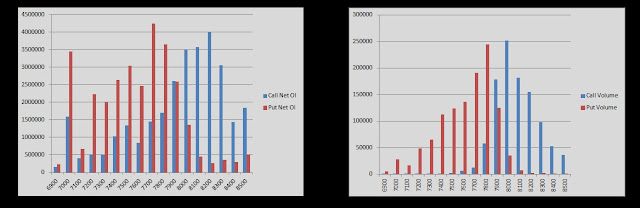

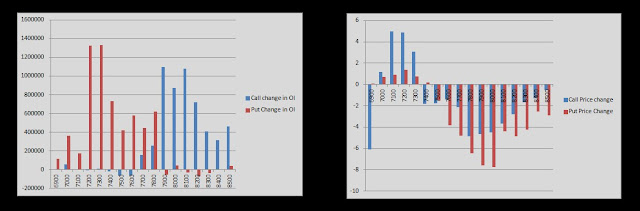

Options Pointers -

Option Contract

shows Range as 7700 - 8000 ( 300 Point - Range squeeze), Currently 7700 Put

having Open Interest 44.5 Lacs & 8000

Call having huge open Interest of 65.85 Lacs .... Also, we will keep an eye on

7000 put OI which was increased to 40.38 Lacs from 34.5 lacs...

PCR ration

is around 0.73 - indicates oversold market as per Option OI.

Pullback is must in next week.

Short

buildup in 7700PE and 8000CE will shows sideway possibility in coming week.

Hence pullback will temporary or for bull trap purpose.

Max Pain is

observed at same 7800 level.

(Last week

Comment -May Month Contract shows Option Range as 7700 - 8200 ( 500 Point

Range), Currently 7700 Put having Open Interest 42 Lacs & 8200 Call having open Interest of 40

Lacs .... Also, we will keep an eye on 7000 put OI which is aroung 34.5 lacs...

PCR ration is around 0.98 - indicates

Sideways price might be possible for in 1st week of may.Max Pain is observed

around 7800 level.)

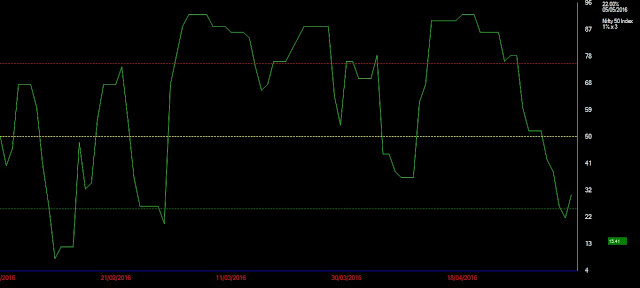

Nifty Breadth Chart -

This is one

more indicator which show the Breadth of the Nifty Stocks means Percentage of

the stocks in Nifty index are in bullish or bearish trend.

Indicator Oscillate

between 0- 100% same like RSI. Below 25%

is oversold & above 75% is Overbought.

Nifty

Breadth is

30% - 6

May

22% - 5 May

26% - 4 May

It indicates

8% of Nifty stocks turns to Positive from Negative trend for short term and

turning from oversold territory which is positive sign which support our

pullback claim for short term...