Long Term View - Bearish to Neutral

Medium Term View - Bullish

Short Term View - Bullish

Weekly

Chart of Nifty -

Weekly Wide Chart of Nifty - From 1st week of March 2104 breakout from 6350, Nifty Rallied and topped out 9120 on 1st week of March 2015. Then, Downfall started and made low till now 6825 on 1st week of April 2016.

Price exactly

took Support from 200 moving average and retraced towards upwards.

The Fall

from 9120 top till now is properly Channelized which is the part of Correction.

Current Counter move of this downfall is bigger than the previous counter moves

and faster . But this Counter move

rallied with lower average volume create question in mind of its sustainability.

Hence, Curious to watch breach of 7980 and 8340 resistance. Breach of 8340 faster

will confirm the end of current downfall.

As per

Elliott wave theory, Complete downmove is complex correction with WXY (2

standard correction adjoined with X1).

We will continued to mark current countermove as X2 until the breach of

8340 (as that was the level confirms the downmove ends).

Also, RSI is

making the higher Swings whereas price couldn't breached its corresponding

price swings which indicate weakness and potential to established the Negative

reverse divergence. Price is to confirm the NRD.

As per

Candlesticks chart, last week closing is formed Doji Candle. Hence it is

important to watch follow weekly candle closing to confirm the further

trend. Doji considered as indecisive candle

but experience says that if Doji comes after good price movement, then it

indicates the maturity of the current trend and it may reversed in next 2-3

candle.

Hence it is

important to watch if any reversal sign on coming days. Beware!!! currently

there is no sign yet of reversal hence bullish trend will continue. i was just

talking about the probability of negative sign on coming days. Do Keep watch, if 7516 breached downside then

only it will confirm the end of current counter move of downfall.

Options

Pointers -

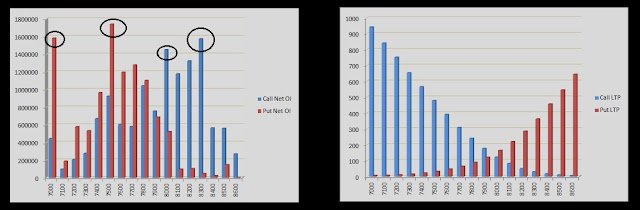

We will analyze

the next month contracts as only 4 days

are left for current expiry. We revisit the Option pointer progress till the

expiry.

Next Month

Contract Shows Option Range as 7500 - 8300 ( 800 Point Range), Currently having

Open Interest Range between 15 - 17 Lacs

which is too low.... There are 7000 & 8000 also having similar Open

interest . Need to observe the increase in Open Interest in each strike price than

only we get clear picture.

PCR ration

is 0.88

Max Pain

will be at 7700