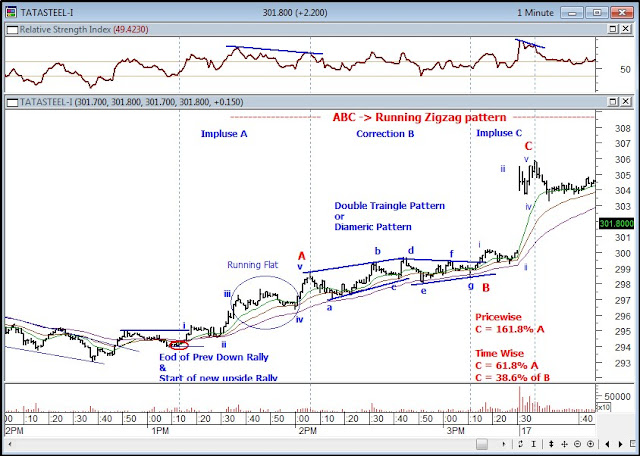

Today, wanted to share my good friend's (Prasad Kulkarni) trade strategy which he traded on Tata Steel future on Monday 28 Mar 2016 and he profited more than Rs.26000/- in a single trade in intraday.

Let us analyse its strategy more in details -

Find out the Resistance Area -

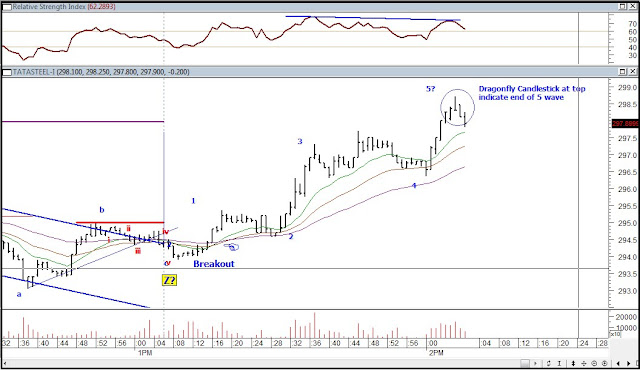

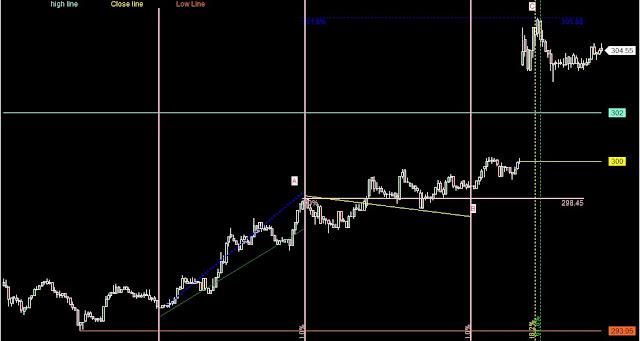

On Daily Chart of Tata Steel, Price is sideways to bullish since Oct 2015. This was just correction rally to previous downfall.

So by using the Fibonacci Price Cluster, 310 -320 is the area identified most probable resistance zone where reaction can come.

Identify the Reversal Sign near resistance zone-

Price is tested this resistance zone on 22 & 23 March, but couldn't identified the reversal sign or pattern rather price was extremely bullish on that days.

After a long holidays(4 days), On 28 Mar, Long Black body spotted on 15 min chart and same time Observed the negative divergence to RSI & Volume on Hourly chart.

Based on this, He didn't waste a time to short Tata steel at 314 with day high as stop. This way he pocketed the highest intraday gain.

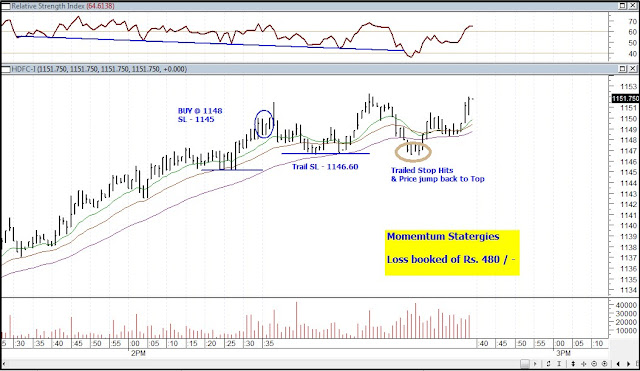

* Trendline Breakout

* Lower low sequence

* Moving Avg crossover

All this works, but need method & experience to trade at right time. Thanks.

Thanks to Prasad for allowing me to share his simple strategy on my blog. Most of the time, Traders follow complicated things but overlook simplicity.